Bay Area Homeowner Guide to Protecting Your Sale, Your Time, and Your Peace of Mind

Selling to a cash home buyer in the Bay Area is supposed to be straightforward: no repairs, no showings, and a faster closing.

But not every “cash buyer” operates the same way. Some buyers back out late in the process, delay for weeks, or lock you into a strong offer — and then reduce the price when your timeline gets tight.

This guide explains:

the most common reasons cash buyers back out

the warning signs that predict delays and cancellations

and a simple checklist to protect your time, leverage, and peace of mind

If you’re already considering a cash offer and want to understand your options first, start here:

👉 How the Cash Home Buying Process Works

Why Would a Cash Home Buyer Back Out?

A real cash buyer should be able to close quickly because they aren’t waiting on:

lender approvals

appraisals

financing conditions

But many companies advertising “cash” still rely on partners, private investors, approval after contract, or contract assignment to another buyer. That’s why some deals fall apart even after the seller signs.

Key takeaway:

✅ A cash offer only matters if the buyer is funded — and obligated to close.

If you want to see what a predictable, funded closing timeline looks like, this gives a clear overview:

👉 Our Buying Process (No Repairs, No Showings)

6 Common Reasons Cash Buyers Back Out (And How to Spot It Early)

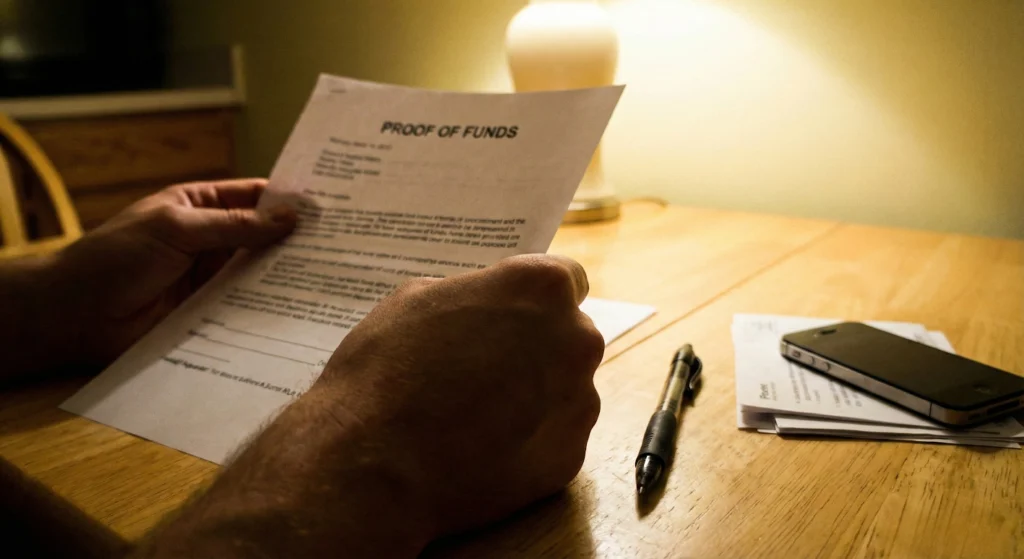

1) They Don’t Have Verified Funds

A buyer can call themselves “cash” and still rely on funding that isn’t guaranteed — like private partners, hard money approval, or investor confirmation after contract.

If the funds aren’t locked in, the buyer may delay, disappear, or try to renegotiate late.

✅ Protect yourself:

Ask for proof of funds before signing, and confirm the funds match the buyer or business name.

2) They’re Assigning the Contract Instead of Buying

Some companies put your home under contract and plan to assign it to another investor. This can be legal — but it’s risky for sellers because the deal depends on someone else stepping in to close.

If they can’t find an end buyer in time, you may experience delays, cancellations, or a reduced offer.

✅ Protect yourself:

Ask directly:

“Will you be the buyer at closing, or will you assign this contract to someone else?”

If your situation is urgent (foreclosure, probate timelines, relocation), you’ll want a buyer who closes directly:

👉 Sell Your House Fast in the Bay Area

3) They Lock You In High — Then Drop the Price Late

One of the most common patterns sellers experience looks like this:

High offer → long inspection period → delays → new repair claims → lower price near closing

It works because once you feel committed — packing, planning, telling family — restarting the process feels exhausting.

✅ Protect yourself:

Make sure your contract limits renegotiation, sets clear deadlines, and avoids vague “inspection satisfaction” language.

4) They Misjudged Repairs or Bay Area Costs

Bay Area homes can come with expensive surprises:

foundation movement (hillside neighborhoods)

sewer laterals

older electrical/panels

unpermitted additions

permit retrofits

fire-zone insurance complications

Inexperienced buyers may underestimate these costs and then cancel or reduce the price once they realize the numbers don’t work.

✅ Protect yourself:

Ask:

“What repair budget are you assuming?”

“What comps are you using?”

“Have you closed in my city?”

If your home needs repairs and you want a realistic as-is offer, this page explains how that works:

👉 Sell a House As-Is in the Bay Area

5) Title Issues, Liens, Probate, or Ownership Complexity

Many deals slow down when the title report reveals complications like:

probate or trust situations

liens, judgments, or unpaid property taxes

HOA balances

multiple owners

tenant complications

unpermitted structures affecting title clearance

These issues don’t automatically kill deals — but they expose whether the buyer has the experience and structure to handle them.

✅ Protect yourself:

Ask:

“Which title/escrow company will you use?”

“Have you closed probate or lien situations before?”

If you’re selling an inherited property or dealing with probate timelines, start here:

👉 Selling an Inherited House in California

6) Their Contract Makes It Easy to Walk Away

Some buyers use contracts with vague escape clauses, such as:

“subject to buyer approval”

“subject to funding”

“subject to partner review”

“subject to satisfaction”

The problem isn’t contingencies — it’s that the wording is so broad the buyer can cancel anytime, even if nothing truly changed.

✅ Protect yourself:

Avoid vague clauses and request clear timelines, limited contingencies, and written expectations.

What a Cash Buyer Backout Really Costs Sellers

When a cash buyer backs out, sellers usually lose more than the deal:

Time — weeks disappear while the buyer delays

Leverage — you stop exploring other offers

Momentum — future buyers may wonder what happened

Money — mortgage, storage, rent, carrying expenses

Peace of mind — especially if your timeline is already tight

This is why the buyer matters just as much as the offer.

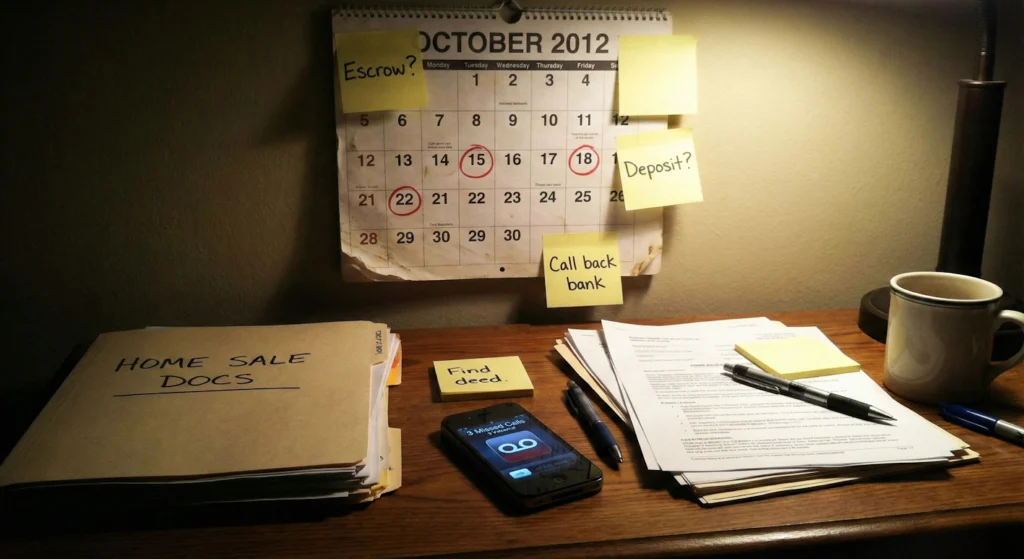

Simple Seller Checklist (Before You Sign)

Use this checklist to protect yourself before committing:

Buyer + Funding

☐ Proof of funds provided before signing

☐ Funds match buyer/business name

☐ Buyer confirms they are the actual buyer (not assigning)

Escrow + Timeline

☐ Title/escrow company named upfront

☐ Escrow opened within 24–48 hours

☐ Closing date written in the contract

Earnest Money Deposit (Huge Protection)

☐ EMD amount confirmed

☐ Deposit date confirmed

☐ When it becomes non-refundable is defined

Contract Safety

☐ No vague “buyer approval” or “subject to funding” clauses

☐ Short inspection/due diligence timeline

☐ Clear boundaries for renegotiation

Keep Your Leverage

☐ Don’t stop exploring options until escrow is open

☐ Keep a backup buyer warm if timing is important

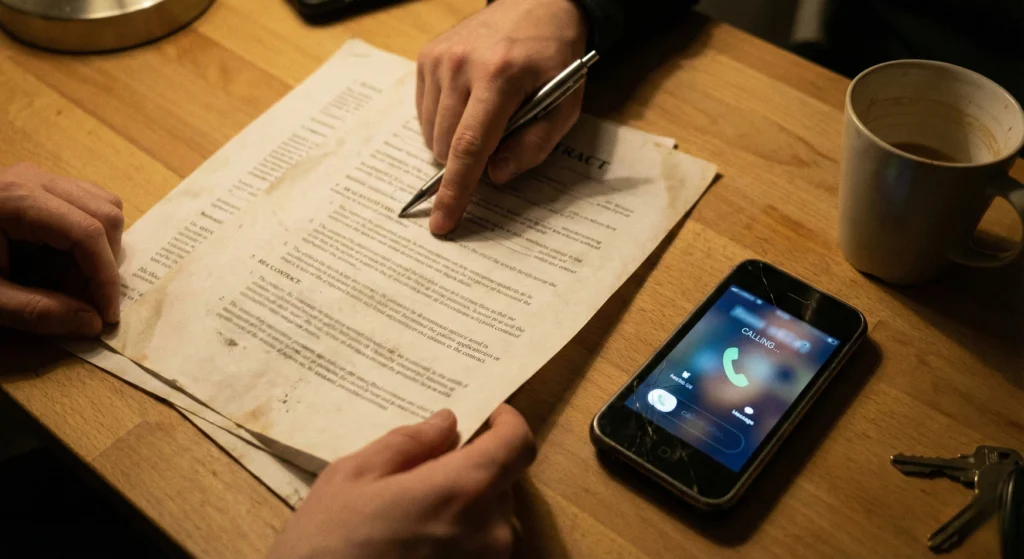

What to Do If a Cash Buyer Is Delaying

If your buyer stalls after you sign, assume one of three things:

they don’t have the funds locked in

they’re trying to assign

they’re setting up a price reduction

✅ Step 1: Confirm escrow is open (ask for the escrow officer’s name and contact info)

✅ Step 2: Set deadlines in writing (escrow, EMD deposit date, closing date)

✅ Step 3: Build backup options immediately

✅ Step 4: Move on if the pattern continues

If your timeline is urgent, this page explains fast-sale options:

👉 Fast Closing Options (7–21 Days)

A Quick Note: How Twin Home Buyer Prevents Backouts (No Pressure)

Most backouts happen for predictable reasons: unclear funding, assignments, vague contracts, and inconsistent process.

Our process removes those failure points:

we buy homes as-is

we provide written terms early

we open escrow quickly with reputable local title/escrow

we don’t rely on contract assignments

we keep communication clear and consistent

The goal isn’t pressure — it’s clarity.

Want a Second Opinion on an Offer?

If you’re comparing offers — or already under contract and unsure whether the buyer will close — a second opinion can save you weeks of uncertainty.

You can request a transparent offer and compare:

timeline

certainty

terms

and closing structure

What Our Clients Say

⭐ Trusted by Homeowners Everywhere

We’re proud that 92% of our customers rate their experience with us as excellent.

Rafael P.

Stress free process, paid all the closing costs and didn’t have to do any cleaning or repairs. Juan Diaz and team are men of their word. Very professional and respectful. The escrow process was a piece of cake. The best part is they close faster than any realtor listing the house ever could. If you’re looking for a no hassle way to sell your house quickly then I definitely recommend Twin home buyer and team.

Robert R.

I can’t speak highly enough about Juan Diaz and his team at Twin Home Buyer. I'm truly honored to be able to work with them and learn from them. Their professionalism, knowledge, honesty, integrity, and hard work ethics are very much admired and respected. They are highly experienced, detail oriented, honest, and truly care about their clients' needs. They deliver on their promises and go above and beyond to get the job done. I look forward to continuing to work with them. I recommend them 100%!

Edgar R.

Called Twin Home Buyer with questions about my property. They listened, offered honest advice, and followed up just like they said they would. Super kind and no pressure. I haven’t sold yet, but I’d definitely recommend giving them a call. Great people!

Jose J.

The twin home buyer was awesome to deal with although they did not buy my house. They recommended me over to an amazing realtor that was able to get top dollar for my property. They let me know upfront that it was not the right match that they could not help me, but it didn’t stop there this company generally cares

Gabriela G.

I've had the opportunity to work with Twin Home Buyer on a few occasions. And everytime has been a great experience. They do excellent work! Juan Diaz is Honest, trustworthy and very easy to work with. I always recommend him to my clients when they want a cash, quick close. I look forward to keep working with them in the future.

Tewfik H

I met with Juan Diaz on Saturday April 2nd and after showing him my property we sat down and discussed price. We finally agreed on a price that was not far off my asking. I felt strongly that Juan was genuine. He sent me a sale and purchase agreement that afternoon. I reviewed and had an advisor from HomeLight review it. The advisor said it was a "good agreement" and that it was "solid". I proceeded with the agreement on April 4th with up to 60 days to close. I may close sooner if I wish. Before meeting Juan I was dealing with two RE agents. One was great bit she overpromised the selling price, even when I presented her with contradictory comps. The other RE agent was pushy and persistent. Both agents wanted me to pour more money into the property. I felt that repairs and improvements were constantly draining my energy. What Juan gave me was a solution to my endless repairs and freedom from dealing with agents. He also alleviated my concerns by offering an Earnest Money Deposit of $50K. That's more than the standard $19.5K. He will also pay all the closing costs. All I would be responsible for is paying off the loan. I was almost immediately notified by the Title Company that the money was in Escrow. To sweeten the deal he also offered to have his guys move our stuff. I told him that I did not expect that but I definitely welcome it. Today someone dropped off 10 heavy duty boxes as I had requested. What more, there's is no need to clear out all of the junk that we accumulated over the years. That's a big help along with the 60 days. Moving is a stressful period in life and Juan made it that much easier. Now I will sit back and wait for an opportunity to buy again.

Tewfik H

Twin Home Buyer made selling my house simple and hassle-free. Their offer was fair, and they handled everything efficiently. I couldn’t have asked for a smoother experience!..

Abbas M.

Very seamless and professional. They do exactly what they say they would do. We work with a lot of sellers and I continue to refer to Juan and team for those who want to sell quickly and with the least hassle.

Suzanne P.

I had the pleasure of being contacted by one of the team members with Twin Homes. She was very pleasant to speak with and asked me to assist with the sale of one of their homes. She was prompt and available when I needed her. I later spoke with Juan Diaz who exemplified the values I stand for as a real estate professional. I have had such pleasant interactions with the entire team that I would always pick up the phone for them. If you have the opportunity to work on the buy or sale side I am sure you will be surprised with the communication and attention to detail they show. They have done the big and little things very well.

Gabriela G.

I've had the opportunity to work with Twin Home Buyer on a few occasions. And everytime has been a great experience. They do excellent work! Juan Diaz is Honest, trustworthy and very easy to work with. I always recommend him to my clients when they want a cash, quick close. I look forward to keep working with them in the future.

Bianca C.

What sets Twin Home Buyer apart is their personalized approach to customer service. The team took the time to understand my unique needs and provided tailored support and guidance every step of the way, ensuring a seamless selling experience. Overall, I couldn't be more satisfied with my experience with Twin Home Buyer. If you're considering selling your home and want a hassle-free, fair, and transparent process, I highly recommend reaching out to Twin Home Buyer.

Frequently Asked Questions

Can I sell my house in the Bay Area if it has title issues or liens?

+

Yes, you can sell your house in the Bay Area with title issues or liens. Twin Home Buyer specializes in buying properties with legal complications, including title issues, unpaid taxes, and liens. We handle the process for you and help clear these issues, allowing for a quick sale in the Bay Area.

How do you handle title issues or liens when buying a property in the Bay Area?

+

We work with legal professionals and title companies in the Bay Area to resolve title issues and liens, ensuring a smooth transaction. You don’t need to worry about any of the legal complexities—we take care of everything to make the process fast and easy.

Will I get less money if my house in the Bay Area has title issues or liens?

+

While title issues or liens may affect the value of your property in the Bay Area, Twin Home Buyer offers a fair cash price based on the condition of your home and its market value. You’ll still receive a competitive offer, even with these complications.

How long does it take to sell a house with title issues in the Bay Area?

+

The process may take a bit longer than a typical sale, but Twin Home Buyer works quickly to resolve title issues. In many cases, you can still close the sale in a few weeks, depending on the complexity of the issue, even in the Bay Area.

Do I need to pay off the liens before selling my home in the Bay Area?

+

No, you don’t need to pay off the liens before selling. Twin Home Buyer can purchase the property with the liens in place and work to clear them as part of the sale process. The amounts owed will typically be deducted from the sale price, even in the Bay Area.

Sell Your Home Fast for Cash with Title Issues or Liens in the Bay Area

If you're facing title issues or liens, Twin Home Buyer is here to help. Get a no-obligation cash offer and close in as little as a few days.

Get A Cash OfferRecent Blog Posts

Expert tips on selling your house fast, cash offers, and real estate insights

Explore more articles and insights from our blog

Explore All Articles